Online Commodities Trading Service in Vaishali Nagar, Jaipur, MaxGrowth

Commodity trading is the exchange of different assets, typically futures contracts, that are based on the price of an underlying physical commodity. With the buying or selling of these.

What is Commodity Trading? How to Trade Online? Get Paisa Online

Example of Margin: A broker's 'margin requirement' on a $1000 gold CFD trade is at 5%. The trader would need to deposit 5% of $1000 to open the trade, which comes to $50. Leverage in trading is expressed as a ratio and is determined by the margin value. It shows the trade's value in relation to the deposit amount.

5 Key Questions to Ask a Commodity Trading Advisor StoneX Financial

Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. Intraday commodity trading on Dhan - Trade commodities seamlessly with Instant Margin, Tradingview Charts, & Option Chain. Start commodity trading at ₹20/order.

How to Trade Commodities Commodity Trading CMC Markets

eToro: eToro is one of the best commodity trading platforms that supports more than 40 commodity markets. Amongst the commodities available include gold, silver, wheat, oil, cotton, and cocoa. As well as supporting commodities, eToro can be used to trade stocks, cryptos, forex, and indices.

Commodity SAMIN FINANCIAL SERVICES PVT LTD

Commodities Commodities Top Performers Intraday 3M 6M 1y 5y Commodity Prices Latest Stories Business Insider 16h US crude production is set to notch new records through 2025, helping send oil.

Commodity online trading

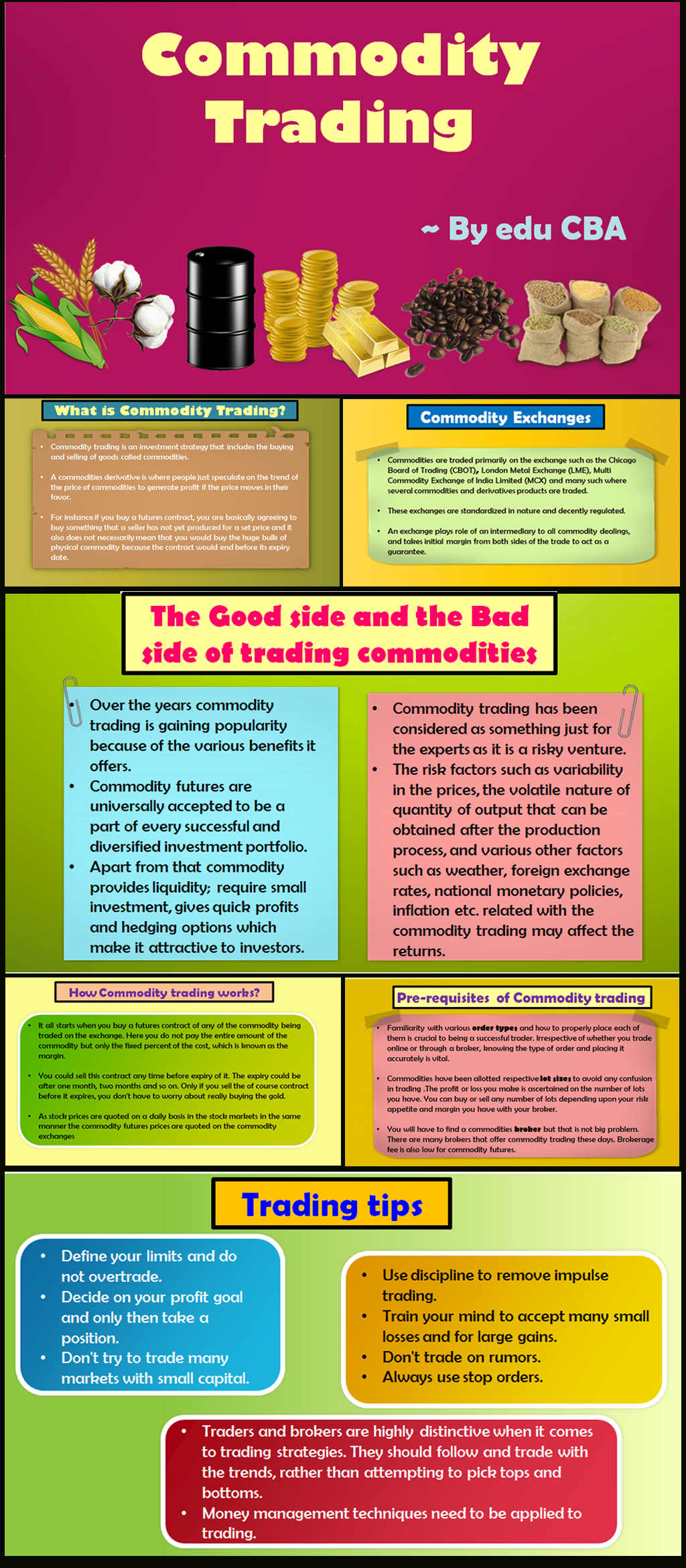

Commodity Market: A commodity market is a physical or virtual marketplace for buying, selling and trading raw or primary products, and there are currently about 50 major commodity markets.

Commodity Trading eBook AudioBook IntroBooks Online Learning

A commodity is a basic good used in commerce that is interchangeable with other goods of the same type. Traditional examples of commodities include grains, gold, beef, oil, and natural gas. For.

What Is The Commodity Trading ? Basic Types Online

In Energy and Metals, short-term options are known as Weekly options where options expire on the corresponding day of the contract week. For example, a Gold Weekly Monday option terminates on Monday of the contract week. In Agriculture, there are three types of short-term options 1: Weekly options, New Crop Weekly options and Short-Dated New.

The Benefits of Trading Commodity Options Over Futures Trading

Trading commodities such as gold, silver, oil, and other natural resources has become increasingly popular in recent years. With the rise of advanced trading systems and tools implemented in commodity trading apps, trading these assets is now easier than ever.. TD Ameritrade is a leading online trading platform that offers access to various.

Trader le Forex ou les Options binaires ? Le choix du trader

Open an Account Open an Account Invest in energy commodities and other sectors like agriculture, metal, and raw materials. FINRA BrokerCheck Forms & Agreements

Comprehensive Guide on Commodity Trading Pros, & Cons

Trading commodities online is a relatively simple process, but it is not an activity that you should pursue without doing lots of homework. The traditional method of calling a commodity broker to place orders and waiting for a call back to give you a filled order price is less efficient than online trading.

How To Trade Commodities Forbes Advisor

Best Commodity Trading Apps eToro USA: Best for commodity ETFs Goldco: Best for buying gold Interactive Brokers: Best for global trading E*TRADE: Best for margin traders and IRAs.

Commodity ETFs Investing In Precious Metals, Agriculture, & More

Gold and silver are two of the best-known commodities that are used as physical stores of value. Investors can purchase these metals formed into bullion, with standard size and purity. Bullion.

BEST ONLINE COMMODITY TRADING PLATFORM IN INDIA Gill Broking

What is a 'commodity'? Where are they traded? The 6 best ways to trade them Tips and strategies to maximise profits History of Commodities Trading Markets for the exchange of commodities are as old as mankind.

Online Commodity Trading Understanding the Basics and Strategies

Hedgers (commodity companies, retailers, or manufacturers) buy futures contracts created by the exchange. Their aim is to offset the risk associated with price changes. Speculators and traders look to buy low and sell high (or vice versa if going short). In the past, most trading took place on the trading floor.

How to Start Commodity Trading Market Business News

Get updated commodity futures prices. Find information about commodity prices and trading, and find the latest commodity index comparison charts.